Why price spikes keep returning and how households can plan smarter

Price spikes have become a recurring challenge in the global economy, impacting household budgets worldwide. Understanding the factors behind these sudden increases and adopting smarter financial planning strategies can help households navigate these fluctuations more effectively.

Understanding the Causes of Price Spikes

Price spikes typically occur when there is a sudden imbalance between supply and demand in critical sectors such as energy, food, or raw materials. These imbalances can be triggered by various factors including geopolitical tensions, natural disasters, or disruptions in supply chains. For example, extreme weather events can significantly reduce crop yields, leading to sharp increases in food prices. Similarly, conflicts affecting oil-producing regions can cause abrupt surges in energy costs. These triggers are often interconnected, amplifying the effects on global markets and resulting in volatile price movements.

The Role of Global Supply Chains

Global supply chains have grown increasingly complex and interdependent, heightening their vulnerability to disruptions that cause price spikes. When key supply nodes experience delays or shortages, the ripple effects can cause raw materials and finished goods prices to surge rapidly. Transportation bottlenecks, labor shortages, and trade restrictions all contribute to these pressures. Additionally, the COVID-19 pandemic exposed the fragility of supply networks, as shutdowns and fluctuating demand patterns led to widespread shortages and increased costs across multiple industries.

Impact of Inflation and Monetary Policies

Inflationary pressures also play a significant role in recurring price spikes. When central banks adjust monetary policies, such as lowering interest rates or implementing quantitative easing, increased money supply can elevate overall price levels. Conversely, tightening policies can sometimes lead to supply constraints and cost-push inflation. These factors influence the frequency and intensity of price spikes, affecting everyday expenses for households in sectors like groceries, fuel, and housing.

Price spikes in Energy Markets

Energy markets are particularly prone to volatile price spikes due to their sensitivity to geopolitical events and demand fluctuations. For instance, sudden changes in oil production quotas by major producers or weather-related disruptions to natural gas supply can lead to rapid cost increases. This volatility has a direct impact on household energy bills and transportation costs, which in turn can influence inflation rates. Energy price spikes also have broader economic implications, affecting industrial production costs and consumer spending power.

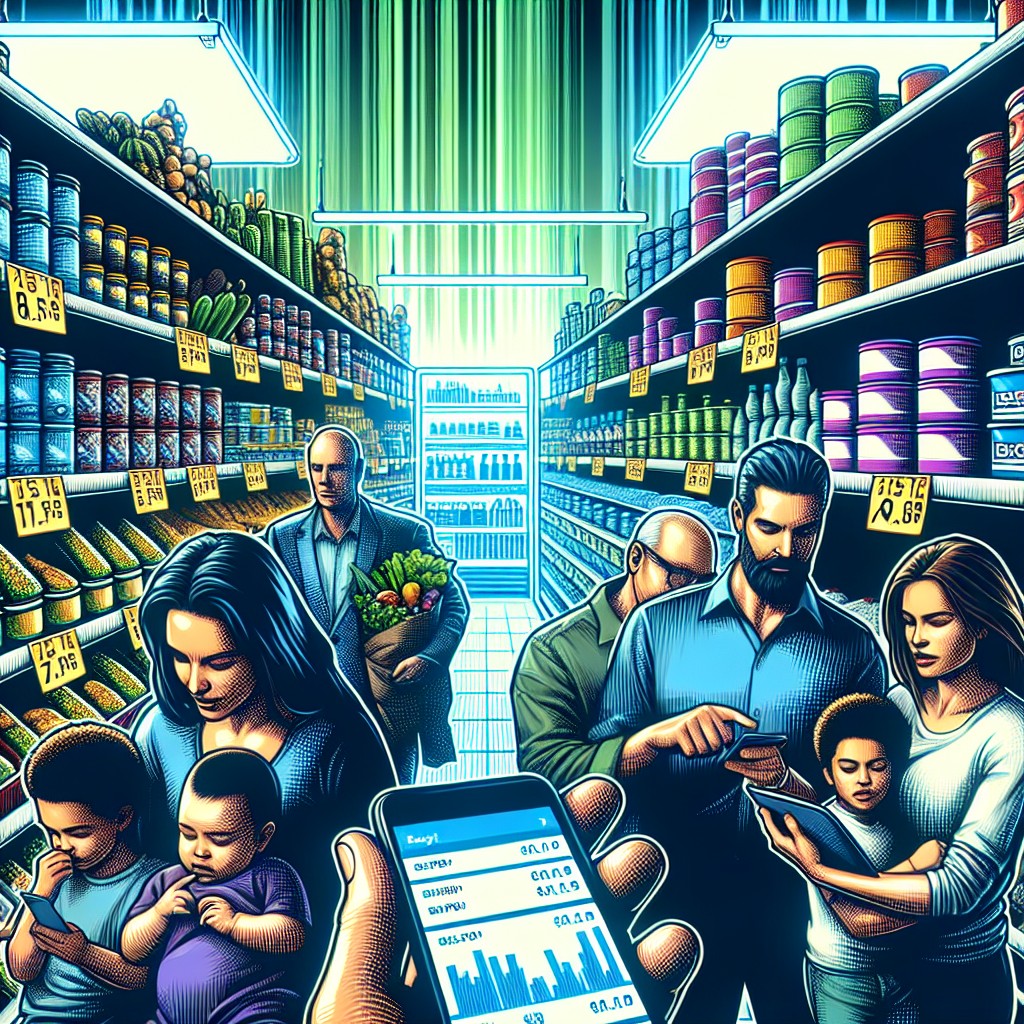

Strategies for Households to Plan Smarter Amid Price Spikes

Households can adopt several strategies to mitigate the impact of price spikes on their budgets. Building a flexible financial plan that accounts for potential cost increases is essential. This includes setting aside emergency savings and prioritizing essential expenditures. Additionally, reducing energy consumption through efficiency improvements and exploring alternative energy sources can help lower vulnerability to energy price spikes. Being attentive to market developments and adjusting purchasing habits, such as buying in bulk when prices are stable, can also reduce exposure to sudden costs. Furthermore, households might consider financial products like inflation-indexed savings accounts to safeguard against the erosion of purchasing power.

Price spikes and Future Economic Outlook

Looking forward, experts anticipate that price spikes will continue to affect the global economy due to ongoing geopolitical uncertainties, climate change impacts, and evolving supply chain dynamics. While technological advancements and more resilient logistics might moderate some volatility, the combination of complex external factors suggests that households should remain vigilant. Staying informed through reliable sources and adapting financial plans accordingly will likely remain critical in managing the risks associated with future price spikes.

Frequently Asked Questions about price spikes

What are the main causes behind price spikes?

Price spikes are mainly caused by sudden disruptions in supply and demand, including geopolitical tensions, natural disasters, and supply chain interruptions that reduce availability and increase costs.

How do price spikes affect household budgets?

Price spikes increase the costs of essential goods and services such as food, energy, and transportation, leading households to allocate more funds to these necessities, which can strain overall budgets.

Can households protect themselves against future price spikes?

Yes, households can plan smarter by saving for emergencies, improving energy efficiency, and monitoring market trends to adjust spending habits and reduce the impact of price spikes.

Do price spikes have long-term economic effects?

Price spikes can contribute to inflation and affect consumer confidence, potentially slowing economic growth if sustained, but they often represent short- to medium-term volatility within markets.

Where can I find reliable information about current price spikes?

Reliable information on price spikes is available through international institutions like the International Monetary Fund, major news outlets such as the BBC, and governmental economic agencies that provide data and analysis.